Why does Indicate Capital exist? The answer is simple. Indicate Capital exists because TIME is of the ESSENCE. The investment real estate industry is a fast-paced business, and nothing kills deals like time.

The application process with a traditional lender is not only painful, but extremely slow and time consuming. Traditional lenders require full document underwriting, personal financials, appraisals, inspections, and typically have a hold up or two with their closing timeline. By the time the lender has requested/received your pay stub for the third time, closing has already passed by two weeks. Additionally, if you are self-employed or 1099, which many real estate investors are, getting a traditional loan in our current climate can be extremely difficult. You finally found that deal you have been searching for all year, only to find out that the bank needs 3-4 months to close. You locked up the deal today, and need to close in one week, what to do now?

This predicament, amongst others, helped push the creation of hard money lenders. Typically, hard money lenders move quicker than traditional banks, and do not have to follow TRID or Dodd-Frank regulations that the conventional world is under. Other hard money lenders still are not fast enough! With more and more hard money lenders requiring credit pulls, tax returns, pay stubs, appraisals, and more; the process has begun to look like a conventional mortgage application.

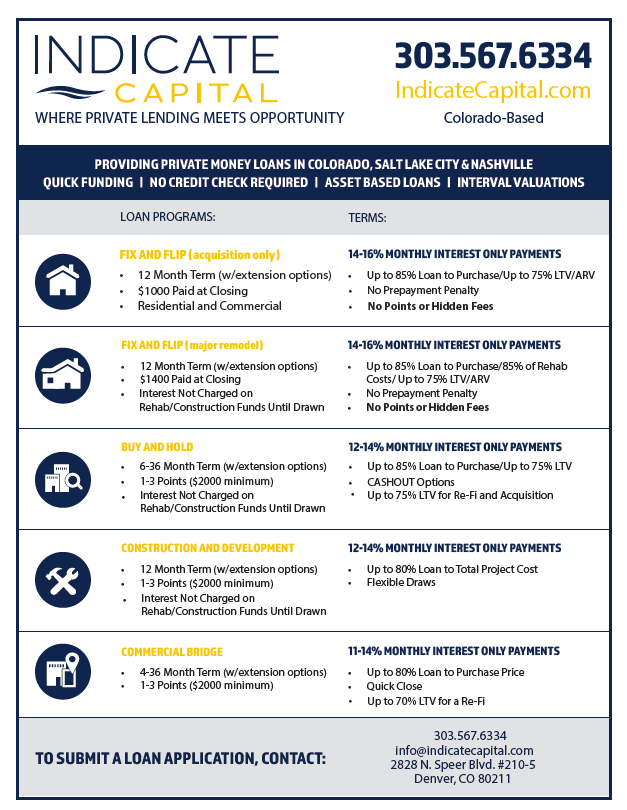

This is where Indicate Capital comes into play! Here at Indicate, we are an asset-only based underwriter. We do not pull credit or require personal tax returns for our residential underwriting. We simply ask that you send over your purchase contract and

scope of work for the rehab/construction being performed. Our in-house residential underwriting system is both fast and effective. From time of loan submission, we aim to have terms out to you within 48 hours in many cases. From there, we can close as soon as title is ready! Sound too good to be true? Well it’s not! No appraisals (on residential deals), no inspections (on residential deals), no requesting updated pay stubs, and no killing time which inevitably kills deals.

We are fast, easy to work with, and provide phenomenal customer service. We work quickly and diligently to make sure your deal closes on time. Most importantly, we stick to our word. We have closed 100% of loans committed to and closed them all on time.

Need financing for your next deal??

Give us a call!

(303) 567-6334

Max Miller